Trade analysis and trading advice for the Japanese yen

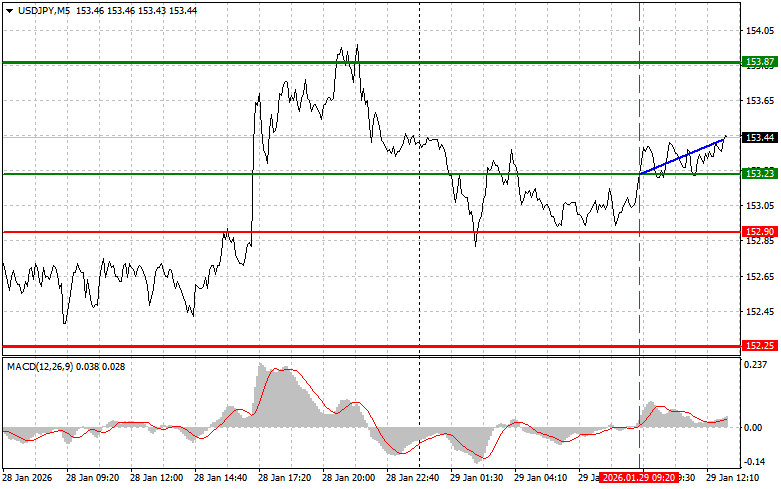

The test of the 153.23 price level occurred at a moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the dollar. As a result, the pair rose by 20 points.

In the second half of the day, market attention will be focused on the release of a number of U.S. economic indicators, including new jobless claims, the trade balance, and factory orders. Favorable readings of these indicators could push the dollar higher and weaken the yen. Otherwise, the USD/JPY pair may resume its decline. Special attention is being paid to the U.S. labor market. A decline in initial jobless claims could act as a driver for dollar strengthening. The U.S. trade balance also plays an important role. A narrowing of the trade deficit or even the formation of a positive trade balance would be seen as a positive signal for the U.S. economy and, consequently, for the dollar. An increase in factory orders would also add confidence, indicating an acceleration in business activity and strengthening economic growth.

In addition to the data, attention should be drawn to today's speech by Japan's Finance Minister, who stated that the government would coordinate its actions with the United States regarding currency interventions when necessary. This suggests that Japanese authorities are no longer concealing the possibility of direct U.S. involvement in the country's currency policy. All of this limits the upward potential of USD/JPY, since a clear currency intervention would be carried out if the rate rises above 159 yen per dollar. However, traders should not rush into selling either, as the dollar is already heavily oversold, and a continuation of the upward correction in USD/JPY cannot be ruled out—especially since the 159 level is still quite far away.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

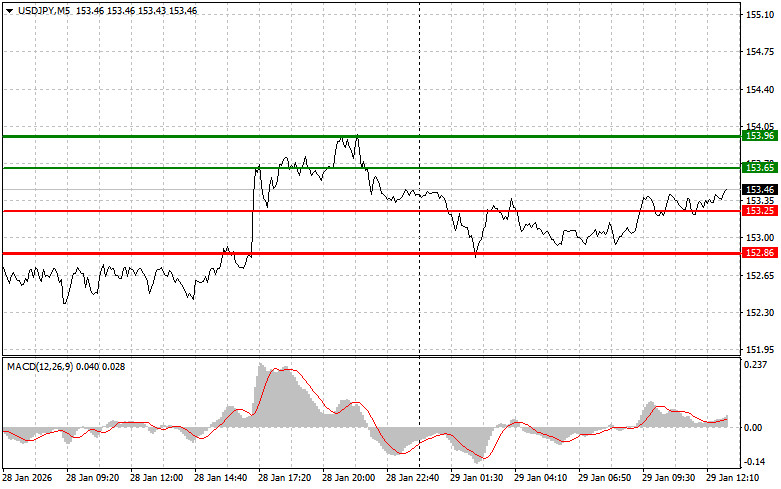

Scenario No. 1: Today, I plan to buy USD/JPY when the price reaches the entry level around 153.65 (green line on the chart), with a target of growth toward the 153.96 level (the thicker green line on the chart). Around 153.96, I plan to exit long positions and open short positions in the opposite direction (expecting a move of 30–35 points from that level). Growth in the pair today can be expected after strong U.S. data.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 153.25 price level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a reversal of the market upward. A rise toward the opposite levels of 153.65 and 153.96 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after a break below the 153.25 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 152.86 level, where I plan to exit short positions and also open immediate buy positions in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pressure on the pair will return in the event of weak economic data.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 153.65 price level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 153.25 and 152.86 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price at which Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price at which Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.