XAU/USD: the current correction may present an opportunity for long?term entries, but only after clear stabilization signals and the emergence of renewed upward momentum

High volatility remains a defining feature of the markets. A vivid example is the price action in gold on Thursday and Friday.

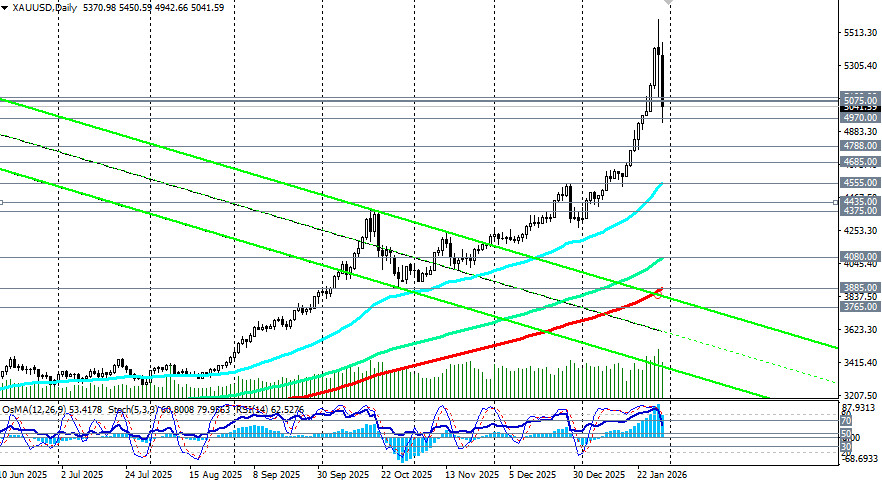

The gold market experienced one of the most dramatic episodes in its recent history over a few January trading days. In just a few hours on the last trading day of the month, the price of the precious metal plunged by more than 8%, collapsing from a record high near $5,600.00 /oz to below 5,000.00. This staggering sell?off — which, by various estimates, wiped about $3.5 trillion of market capitalization off the table — became a severe stress test for the bullish trend that had delivered gold its strongest monthly gain since 1980 (almost +18%).

Why did gold crash? The sharp sell?off, during which XAU/USD lost roughly 13% over two days, was the result of a perfect storm formed by three key factors:

- Technical correction and profit?taking. The almost vertical rise to 5,600.00 created extreme overbought conditions. Such volatility triggered a cascade of margin liquidations, which amplified the decline. Investors, seeing record highs, began mass profit?taking, producing an avalanche effect.

- Monetary shock: nomination of a potential Fed "hawk." The main fundamental trigger was President Donald Trump's announcement of Kevin Warsh as his nominee for Fed chair. Markets perceived Warsh as a more hawkish, market?friendly candidate compared with other contenders. That sharply reduced expectations for an aggressive cycle of rate cuts that investors had been hoping for, despite pressure from the administration. As a result, the US dollar firmed (USDX bounced from a four?year low of 95.50 to 96.50), Treasury yields rose, and non?yielding gold became less attractive in comparison.

- Strong macro data. US producer?price (PPI) data released on Friday exceeded expectations. Core PPI rose 3.3% year?on?year, signaling persistent inflationary pressure. That reinforced the scenario in which the Fed could remain tighter for longer and added to the pressure on gold.

Technical picture

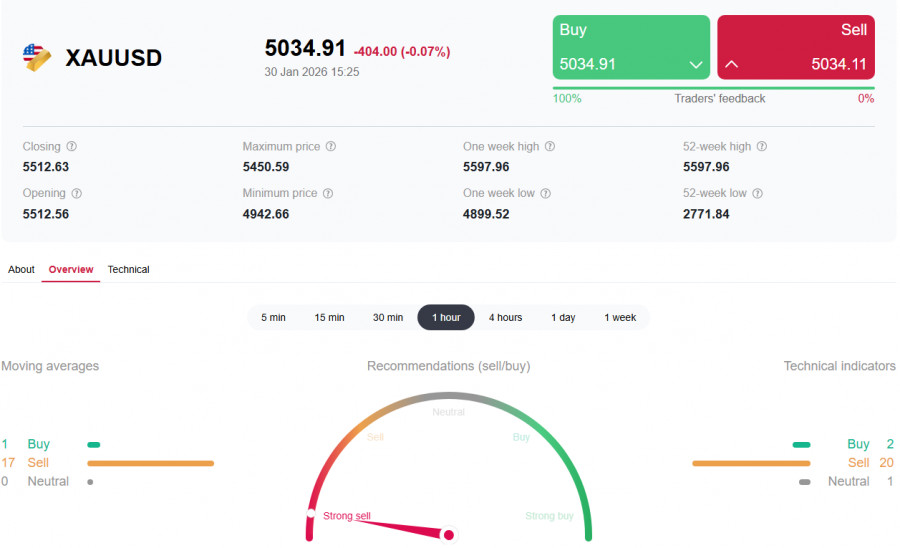

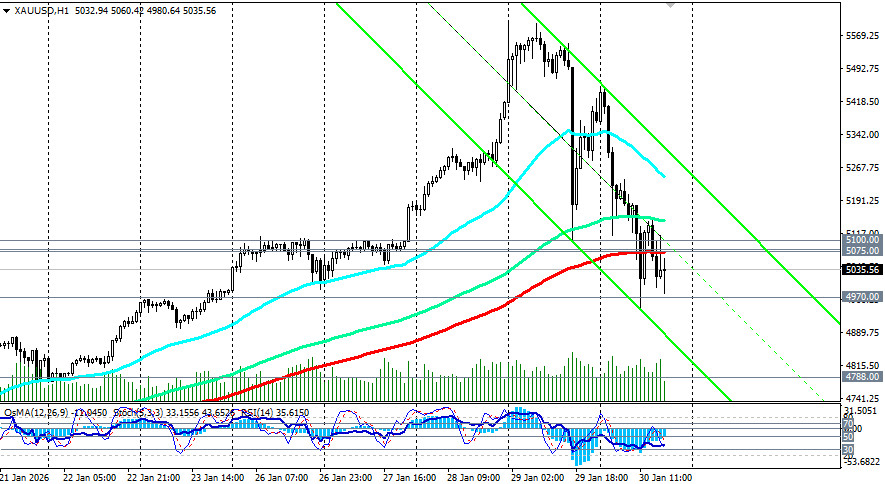

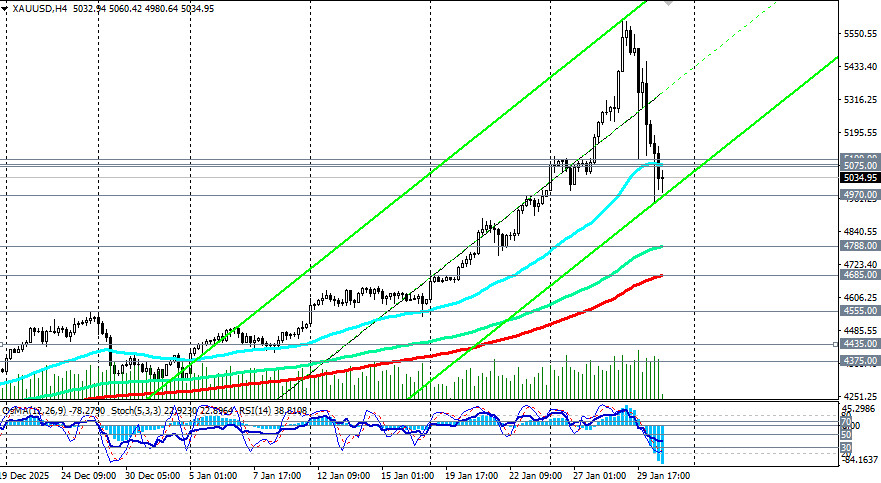

After the sharp drop, the short?term technical outlook shifted bearish.

Key support: The psychologically important 5000.00 level is now the first line of defense.

Resistance: The area around the 50?period EMA on the 4?hour chart (5,075.00–5,100.00) now serves as the first major resistance zone. A return and hold above this zone is required to stabilize the situation.

Indicators: RSI on the 1?hour and 4?hour charts has fallen to 35–40, indicating strong short?term oversold conditions and a loss of upside momentum on the higher daily timeframe. However, the broader long?term trend remains constructive: shorter moving averages (21 and 50) are still above longer ones (144 and 200).

Outlook: what's next? Despite the shock correction, the fundamental drivers of the gold bull market remain intact.

Supporting factors

- Geopolitical uncertainty. Tensions around Iran (US threats and drills in the Strait of Hormuz) and an extended trade conflict with the EU sustain demand for safe?haven assets.

- Economic risks. Broad concerns about global growth and market stability persist.

- Relatively dovish Fed tone. The Federal Reserve put interest rates on hold in its recent meeting and adopted a data?dependent stance. Markets still expect two rate cuts during the year.

Constraining factors

- Strong dollar and a hawkish Fed. The Warsh nomination could support the USD and bond yields in the medium term.

- Inflation data. Continued strength in inflation (especially CPI) will push back expectations for easing.

Possible scenarios

- Consolidation and recovery (most likely). Gold stabilizes in a wide 5,000.00–5,300.00 range and digests the move. Support at 5,000.00 will probably hold, and after a base is formed, a gradual recovery should follow as part of the long?term uptrend.

- Continued correction. A break below 5,000.00 could open the way to deeper declines toward 4,800.00–4,685.00 (200?period EMA on the 4?hour chart) to test next support levels. This is likely if the dollar strengthens further and additional hawkish signals come from the Fed.

- Sharp rebound. This would occur in the event of a new geopolitical escalation or unexpectedly weak US inflation/employment data that would force markets to price in renewed Fed easing.

Conclusion

The gold crash was a powerful — and perhaps healthy — corrective movement in an overheated market. It does not negate the long?term bullish factors such as geopolitical tension and economic risk, but it makes clear that the path higher will not be linear and will depend on Fed policy and the dollar's strength.

Over the coming weeks, XAU/USD will likely remain highly volatile, oscillating between support at 5000.00 and resistance around 5200.00–5300.00. Investors should monitor developments around the Fed chair nomination, upcoming US macroeconomic data (especially inflation readings), and any new geopolitical events. The current correction may offer an opportunity to establish long?term positions — but only after clear signs of stabilization and the formation of a new upward dynamic.