The primary victim of what is happening in the world should first and foremost be the dollar, since the initiator of the changes is America. Under Joe Biden, stability flourished, and investors were confident in the bright future of their investments in the US economy. Everything changed with Trump's arrival. Economists around the world note total uncertainty regarding the US economy and its future, a loss of trust in the American government, possible reactions of trade partners to a new escalation of the war, and an acceleration of the de-dollarization of the global economy.

The last point deserves a bit more attention. For all the reasons listed above, central banks (and probably not only they) began reducing dollar reserves last year. This process may continue this year, since the news background remains the same and only worsens over time. Trade ambitions have been joined by geopolitical ones. And as a pressure tactic, military interventions have been added to tariffs. Now, no country in the world whose views differ from Trump's can be sure that its president will not be kidnapped or that a military confrontation with the United States will not begin.

I would like to remind you that for investors, the issue of the Fed's independence is extremely important. The probability that the Fed will remain apolitical decreases with each passing day. Jerome Powell's departure will not radically change the balance of power within the FOMC. However, a demonstrative dismissal of Powell or the filing of charges against him in court would undermine the Fed's reputation. It would turn out like in the film "Guilty Without Guilt." By law, the Fed must not be subordinated to the president, but the president wants it subordinated, and it is becoming increasingly difficult for the regulator to resist that pressure.

The question before the US Supreme Court remains open as well — the court, which was supposed to cancel the tariffs, has yet to issue a ruling on the trade tariffs introduced by Trump in 2025. The tariffs can still be overturned, but even such a court decision will have little effect. Trump's team is already prepared, if necessary, to reinstate the tariffs by other legislative means.

Many economists and analysts, by the way, doubt that the European Union will respond to Trump's tit-for-tat. Many believe that Brussels' response will be mild and formal. In other words, Europe cannot leave the new tariffs unanswered, but its measures will not be proportionate enough to avoid further inflaming the situation. The main loser in the currency market could be the US dollar again. European states are the largest holders of US Treasury securities, and the EU itself has enough instruments at its disposal to create problems for the American economy. The question is the resolution of European politicians.

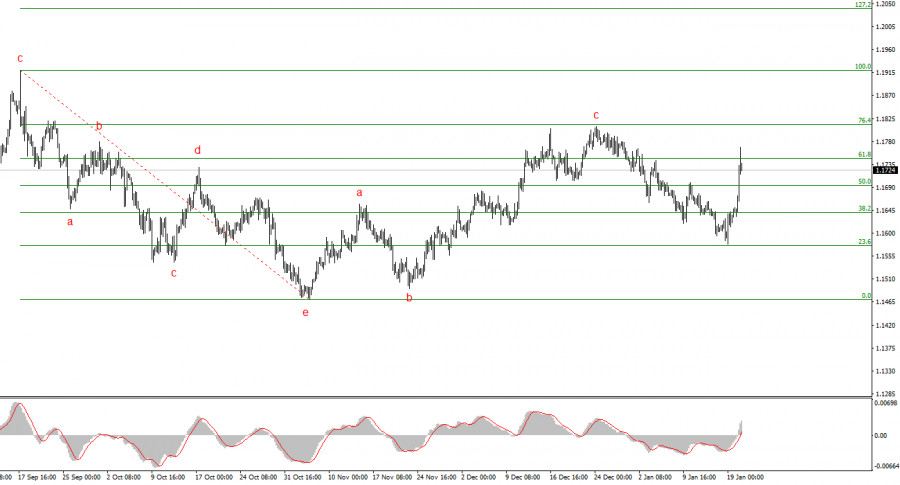

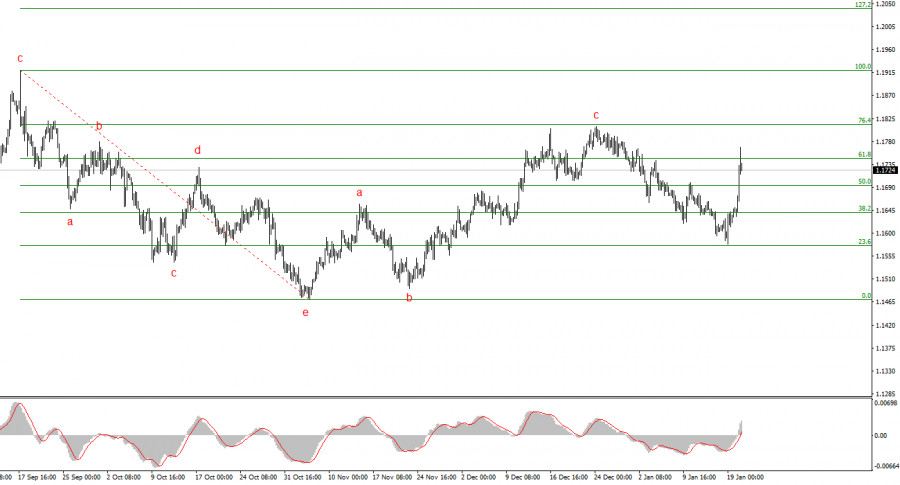

Wave picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. Donald Trump's policy and the Fed's monetary stance remain significant factors for the long-term decline of the US dollar. Targets for the current trend section may extend to the 25th figure. However, to reach those targets, the market must complete the construction of an extended wave 4. Right now, we only see the market's desire to keep that wave going. Therefore, in the near term, a decline to the 15th figure can be expected.

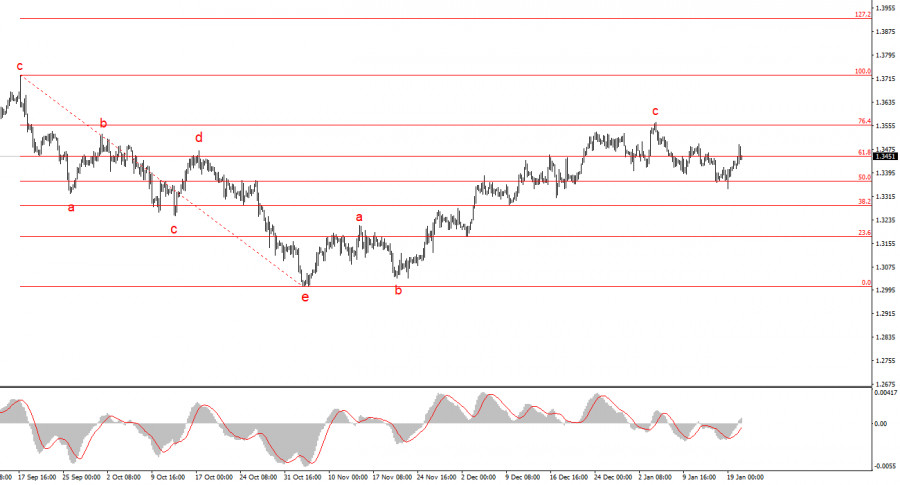

Wave picture for GBP/USD:

The wave picture for GBP/USD has changed. The downward corrective structure a-b-c-d-e in C within wave 4 appears complete, as does wave 4 itself. If this is indeed the case, I expect the main trend section to resume with initial targets around the 38 and 40 figures.

In the short term, I expected wave 3 or c to form, with targets around 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of Fibonacci. These targets have been reached. Wave 3 or c has presumably completed, so in the near term, a downward wave or a sequence of waves may form.

Main principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade, and they often change.

- If there is no confidence about what is happening in the market, it is better not to enter it.

- There is never and can never be one?hundred?percent certainty about the direction of movement. Do not forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.